Market Update

Apr 24, 2022

Friday was not a good day for the markets. With a half point increase in interest rates announced by the Fed the markets tanked. The NYSE (S&P 500) ended the day down 2.8% while the Nasdaq was off 2.6%. Both of these are huge one day drops.

Declining stocks out numbered the advancers by a 7 - 1 ratio on the S&P while the Nasdaq decliners held that ratio to 3 - 1.

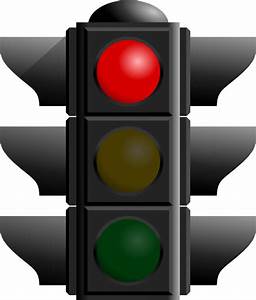

All this negative action tipped the scales and turned our market classification to Red - Market in Correction.

We were previously concerned over the high level of institutional selling days which stood at 6 days for each index. As you will remember, we exit a market when this count reaches 7 days. When we fall into a Red market the institutional selling day counts are erased. We will start to count again when markets return to Green.

We now face a new challenge - market reentry. To reenter from a Red market we will need to see two things:

- a convincing rally of 4 to 5 days where market indexes do not fall below (undercut) the low established at the beginning of the rally.

- a final "follow through day" where indexes advance by at least 1.25% on volume higher than the previous day.

And so we wait. Stay tuned.

Please contact me with any questions.

Duncan Campbell

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.